Everything you need to know about closing costs

All righty, friends. Today, we’re going to cover off on one of the most uncomfortable pieces of the home-buying process—closing costs.

(cue horror movie scream)

I know, I know: Coming to grips with the size and length of your loan can be nauseating. But thinking about the cash you have to come up with—up front—is next-level stressful.

This is 100% a “the more you know” situation. Understanding what’s coming in advance can help you prepare—both financially and mentally—so you can actually enjoy the process of purchasing your home.

Closing Costs in a Nutshell

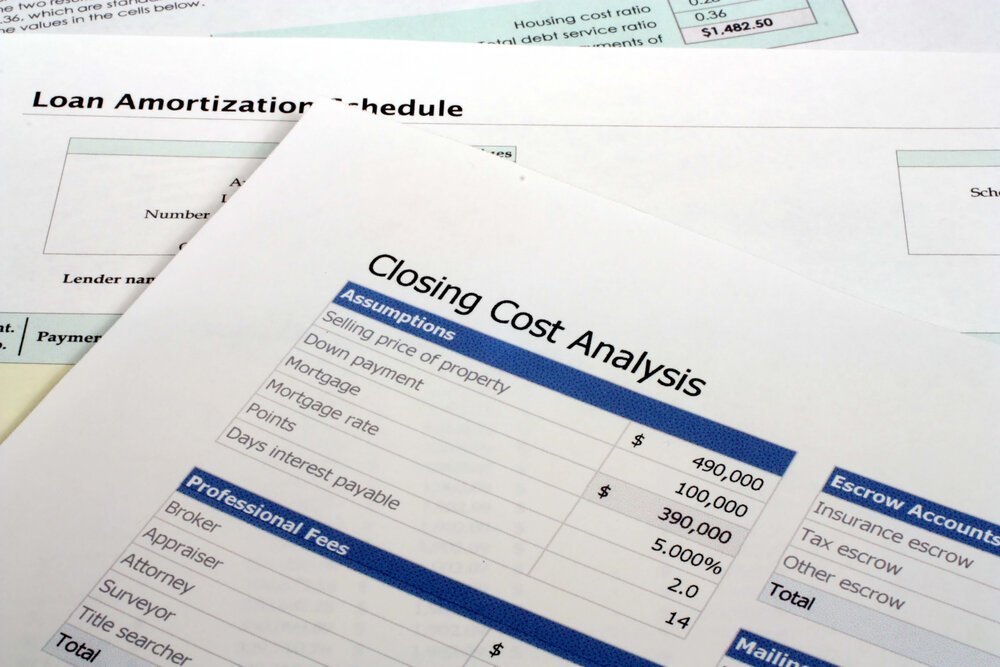

Closing costs include several fees that finalize your real estate transaction. Your lender can give you an estimate of your specific closing costs early on in the process, and you’ll get final numbers a couple of days before you close. If the final numbers are more than the original estimate, you’ll know in plenty of time to exit the contract and keep your earnest money.

Closing costs are typically between 2% and 5% of the home’s value. For example, on a $400,000 home your closing costs will be between $8,000 and $20,000. That’s a huge range, obviously, and that’s because there are quite a lot of variables depending on how you structure your offer.

Typical Closing Costs

Be sure to check out Real Estate in Plain English if you come across unfamiliar vocab. This stuff can be confusing!

Your down payment is the initial cash payment you make toward your home purchase. Your lender will require you to put down a specific amount—typically between 5% and 20% of the purchase price. Check out these down payment tips.

Origination charges are administrative and underwriting costs to process your documents and mortgage application. Next to your down payment, origination charges can be one of the largest individual fees you’ll pay as a part of closing.

Loan application fees are exactly what they sound like—fees you pay in order to submit an application for a home loan.

Appraisal fees are paid to the lender for having an independent person come and assess a home’s value. This step is particularly important because it tells the lender if the property is actually worth as much as the amount you want to borrow from them.

Your lender will run credit check(s) on you, so they include credit report fees in your closing expenses.

In addition to various home inspections (which you’ll actually pay for before you get to closing), you may also need a flood certification if your home is situated on or near a flood plain. Your lender may want documentation from the Federal Emergency Management Agency (FEMA) to learn more about your property and its flood risk.

Government recording fees are paid to your local government to make a public record of the sale, officially changing ownership of your home to you. Yay!

Transfer taxes cover costs associated with transferring the title or deed to you. Again, yay!

You’ll be charged for several title-related fees which have to do with making sure your new property is actually legally available for sale. One optional (but highly recommended) title fee is owner’s title insurance.

You can opt to have a survey done of your property, to show official boundaries between you and your neighbors or common ground.

You’ll also be responsible for a number of “pre-paid” expenses. You’ll typically pay a full year of these expenses at closing, plus an additional three months’ worth if you choose to escrow them:

Homeowner’s insurance

Private mortgage insurance (PMI), if applicable

Property taxes

Homeowner’s association (HOA) dues, if applicable

Pre-paid interest on your loan, which is pro-rated depending on your closing date. For example, if you close on March 15, you’ll pay 16 days’ worth of interest (from the 15th through the 31st). Then, beginning April 1, you’ll make regular monthly mortgage payments that include both principal and interest.

Lowering your Closing Costs

There are a couple ways to lower your closing costs. Most often, people shop around and negotiate some of these fees, and occasionally (rarely in our market), you can convince a seller to cover at least a small percentage of the fees for you. There are also *special programs for first-time home buyers and other strategies to help decrease that final bill.

That’s why it’s reaaaally helpful to have a partner in this process. I’ve got you! Book a no-obligation coffee meeting today.

Written by Dwell Denver